Chapter 5

The Power of Giants

Not all economic and financial actors are equally influential. Our globalised economies contain a considerable concentration of influence and power, possibly putting Earth’s future in the hands of but a few.

In today’s globalised economies, collaborations and networks often place some actors in more central and influential positions. Such actors, in both the corporate world and the financial sector, could use their influence for a just and safe transition towards sustainability.

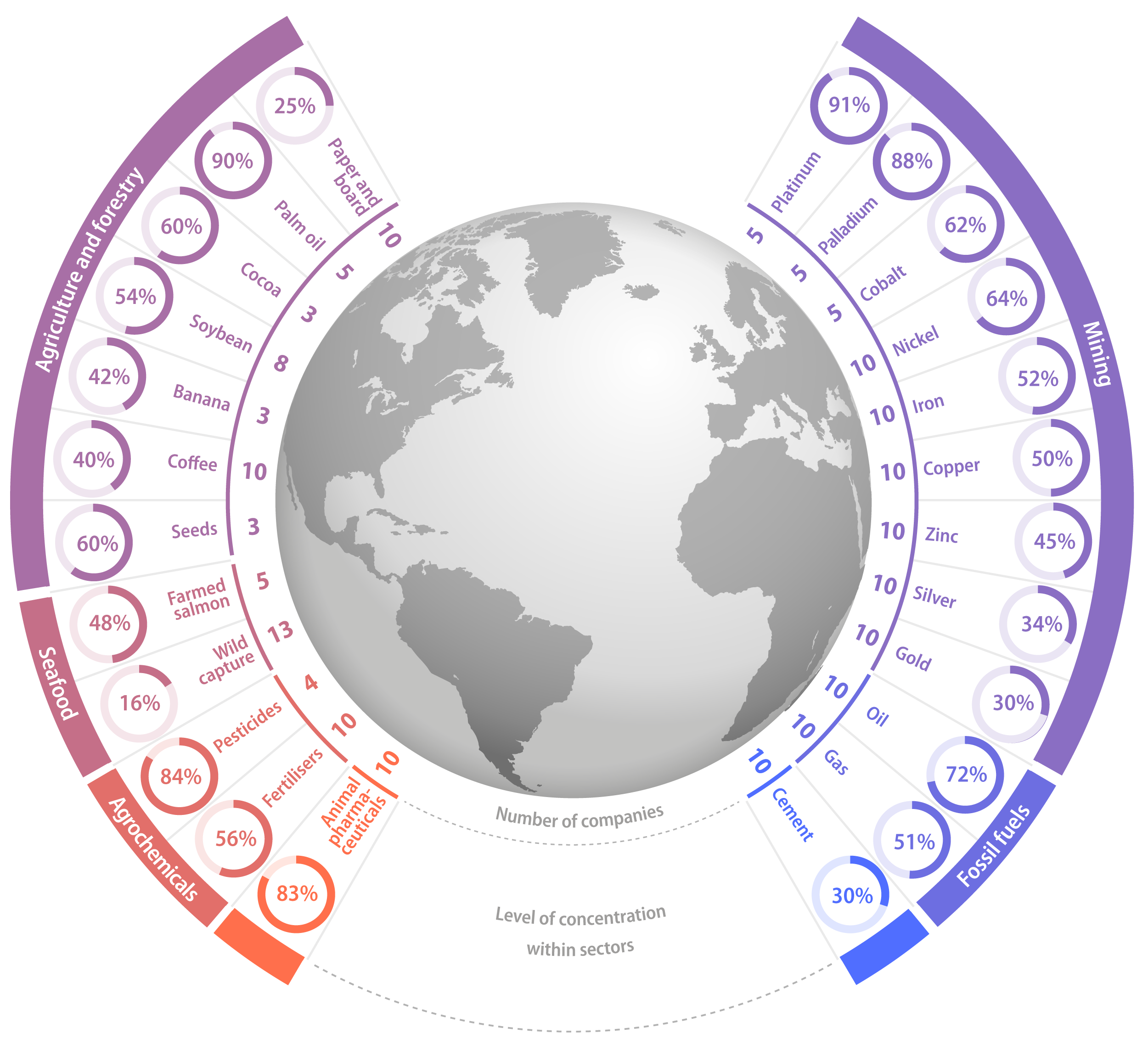

Keystone actors: corporate market concentration

The dominance of a few companies is clear in sectors that impact the world’s oceans, the atmosphere, vast biomes and other aspects of our living planet. For example, four companies control 84% of the agricultural pesticides market. Thirteen companies control up to 40% of the largest and most valuable global fish stocks. And over 70% of the world’s greenhouse gas emissions since 1988 can be linked to only 100 companies.

Transnational corporations like these, so called keystone actors, are typically influential beyond their specific markets – they set global standards that subsidiaries and competitors need to follow, and they influence both national and international policy.

Financial giants: asset managers, index providers, and central banks

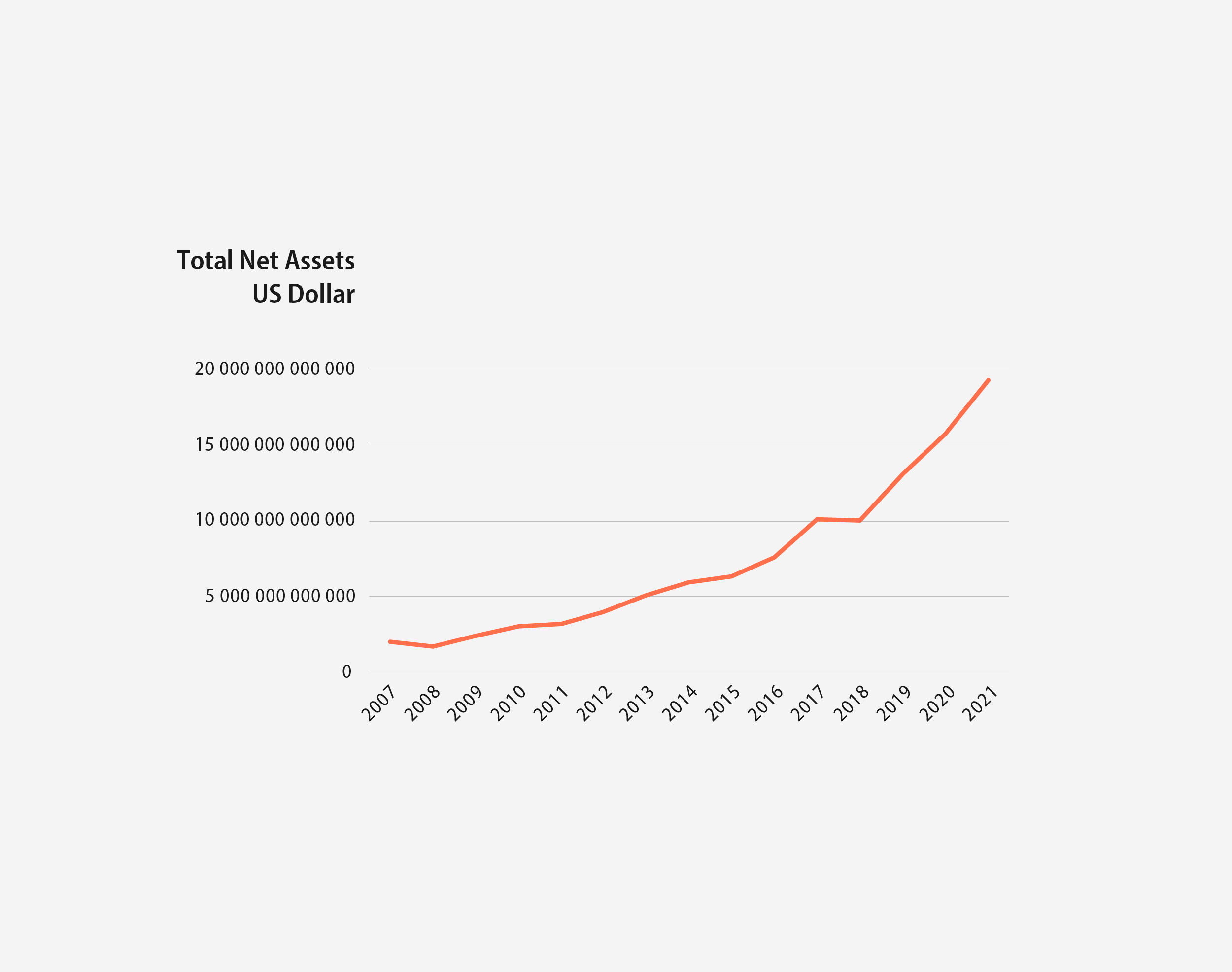

Since the global financial crisis in 2007–2008, a shift in investments has taken place, from actively managed funds to passively managed index funds. From 2006–2018, almost US$3.2 trillion was taken out of actively managed equity funds, and US$3.1 trillion flowed into index equity funds.

That shift primarily benefited the “Big Three” passive asset managers: BlackRock, Vanguard, and State Street, which are becoming ever-larger shareholders of publicly listed companies all over the world.

While the Big Three and other large asset managers do not own the shares they hold, they do exert the voting rights attached to the shares. They also engage in meetings to discuss corporate strategy with the top management of companies in their portfolios. As such, they are “financial giants” with an ever-growing influence in economic sectors of critical importance for both people and planet.

As these giants hold shares in virtually all publicly listed companies and industries, their long-term returns hinge not only on individual firms but on the economy as a whole – something that should constitute an incentive to use their influence to reduce planetary pressures.

The shift towards investments in index funds also put index providers, who determine which companies are part of the respective indices, in a central position. Decisions made by index providers have big impacts on the financial sector, as could be seen, for example, after Chinese companies were included in big benchmark indices in 2017. As a result of the inclusion, the inflow of foreign capital into Chinese markets is estimated to be up to US$400 billion over the next decade. A mere 33 index providers hold a combined market share of over 70%.

Central banks and financial supervisors have been gaining attention as key actors in shifting the financial sector towards contributing to international climate ambitions and the Sustainable Development Goals. Tasked with maintaining price and financial stability, central banks have also started to explore the implications of environmental threats beyond climate change, focusing primarily on potential impacts on macroeconomic stability from biodiversity loss.

From insight to action on a changing planet

Central banks, asset managers, index providers, and “keystone actor” corporations are centrally placed and can help create and shape markets in ways that have deep impacts on our living planet and the climate system. Engaging with such influential economic and financial actors offers possibilities, but transparency, accountability and strengthened regulation will be key to securing outcomes that benefit sustainability ambitions and a just transition.

It all connects: the financial sector puts pressure on the climate system and the biosphere; in turn, it is exposed to risks by a changing planetary reality. Financial giants need to address both sides of this loop.