Chapter 6

What if the Amazon tips? Exploring the implications for investors

Paula Sánchez García and Bianca Voicu

The tipping of the Amazon rainforest into a savannah is considered to be a “green swan event”, a potentially extremely financially disruptive event, with wide-ranging social, economic and ecological implications (Bolton et al., 2020). Indeed, impacts on carbon emissions and, hence, global climate stability, or on regional agriculture (Lenton et al., 2019), are often referred to as the main material risks for financial institutions as a result of crossing a tipping point in the Amazon rainforest (Santander, 2021; Stand.Earth, 2022; Svartzman et al., 2021). However, our understanding of how rainforest dieback could lead to large changes in the hydrological cycle within South America, and cascade in ways that amplify financial risks, is limited (Lamb et al., 2022). This chapter brings together insights from climate and hydrological models, with financial data to elaborate the anatomy of such risks.

Aerial rivers and changes to precipitation patterns in South America

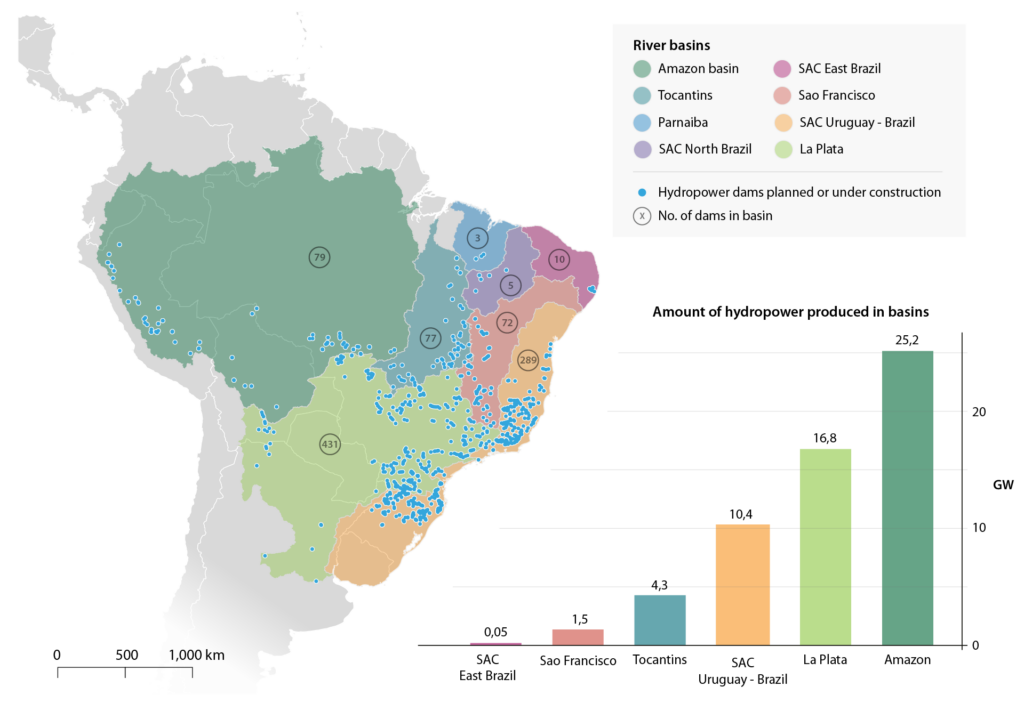

Large-scale rainforest dieback will significantly impact the capacity of the Amazon rainforest to act as a unique hydrological recycling hub. As a result, such a dieback increases the risk of a collapse of the network of water vapor transport which underpins the “aerial rivers” that reach within and beyond the region (Zanin and Satyamurty, 2020). Land use change is expected to significantly impact precipitation patterns in the Peruvian Amazon and western Bolivia, a region which receives 70% of its precipitation originating from the Amazon rainforest (Weng et al., 2018). Furthermore, shifts in the process of water recycling and transport of water vapor through changing patterns of evapotranspiration is predicted to also impact the Atlantic Forest (Ferrante et al., 2023), and the La Plata Basin (Zanin and Satyamurty, 2020). The extent to which different regions in South America might be impacted by a fall in precipitation as a result of land use change in the Amazon rainforest is illustrated in Figure 1.

Figure 1. Impact of deforestation in the Amazon rainforest on precipitation in South America. The shaded green area showcases the physical boundaries of the Amazon rainforest. The area in orange shows regional dependence on precipitation originating within the Amazon rainforest, with darker shades indicating higher dependency.

Implications for investors

Whether due to a regime shift (see Chapter 4) from tropical rainforest to a savannah, or due to wider system impacts on climate and the hydrological cycle, the alarming levels of deforestation in the Amazon represent material risks to investors and financial stability. The increase in extreme temperatures due to climate change and exacerbated by El Niño have already triggered draughts of unprecedented severity, with direct impacts on the Amazon Basin. In addition to the severe stress on the riverine biodiversity, the record low water levels in the Negro and Madeira Rivers in Brazil saw communities stranded and a large hydropower closed (Knutson, 2023; The Guardian, 2023). As scientists warn of an increase in extreme weather events, this has particularly significant consequences for not only the people of the Amazon, but also in the longer term for the just transition to a low-carbon economy in Latin America as countries in the region are relying on an increasing capacity of the hydropower sector for its green energy sector (McCauley et al., 2023; IEA, 2021).

The electricity generation potential of hydropower plants is thus likely to be negatively impacted by longer periods of drought due to a reduction in precipitation patterns (Shu et al., 2018). Investors and national governments can minimize the risk of stranded assets by mapping which hydropower plants are at risk of such abrupt shifts in precipitation.

Our initial analysis shows that 998 hydroelectric powerplants (documented as being either in construction or with planning approved in South America), constituting a total of 66.97 GW, are most likely to be affected by decreases in precipitation in four countries (Brazil, Argentina, Peru and Bolivia) and within eight river basins (see Fig. 2). Out of the 998 dams identified in risk regions, 65 of the largest dams, accounting for about 64% (42.61gW) of future power generation, are located in Brazil (26), Peru (24), Bolivia (11) and Paraguay. Although the extent to which electricity production will be affected by extreme weather events will differ, a disruption to the hydrological cycle increases the risk of power plants to become stranded assets.

Figure 2. Hydropower stations in constructions or in planning across basins at risk of decreasing levels of precipitation. The map showcases the main river basins which are likely to be impacted by changes in the hydrological cycle as a result of a tipping of the Amazon rainforest. The dots mark the location of all hydropower dams planned or under constructions within the boundaries of these basins.

Out of the 65 hydropower projects under analysis, 15 were under the control of a consortium with at least one publicly-listed company, bringing the total to 10 different publicly-listed companies investing in these projects. Nevertheless, the financial implications extend beyond the region. For example, 63% of the 548 are located in the Global North, with US, Spain, Great Britain, Canada, France, Germany, Switzerland and Bermudes being represented most. A total of 438 total unique shareholders, with at least 0.01% of ownership, could have investments at risk, including banks (131), individuals or family groups (127), corporation companies (103), mutual pension funds and trustees (58), finance companies (53), public authorities, state institutions and governments (29), insurance companies (29) and foundations or research institutes (6).

The top 30 unique shareholders own about 80% of the $169.14bn in total equity, of which eight are state agencies and the governments, totaling $43.63bn in shares. Large US-based asset managers (The Capital Group Companies Inc., BlackRock Inc., Vanguard Group, and State Street Corporation) own 18% of the total equity size and have investments across several of the 10 publicly listed companies under analysis. Notably, the Brazilian government controls more than 48% of a few small companies, while another four unique shareholders (SAS Rue La Boetie, State Street Corporation, JPMorgan Chase & Co, The Government of Canada) are found owning shares in at least six of the publicly listed companies, although the investments is comparatively small, less than $3bn.

Here we have shown the risk of investments becoming stranded assets due to a possible transgression of a tipping point in the Amazon, and its impacts on precipitation patterns at the regional scale. Nevertheless, this analysis has broader implications for investors. Physical risks are highly relevant for the owners of hydropower plants in the affected regions, while potential changes in public awareness and regulation can represent high transition risks for investors who fund deforestation-linked activities. Furthermore, many of the large hydropower plant projects have been opposed by indigenous and local communities due to the high social and ecological costs such projects would have incurred (Mapstone, 2011). Furthermore, as the recent draught in Manaus has shown, prolonged draughts, which can be the effect in hydrological cycle, have impacts beyond electricity generation, extending to agriculture and communities dependent on riverine routes for supplies (Knutson, 2023). The social and financial risk incurred by lower precipitation levels further emphasize the need for policies and enforcement in Amazon countries that limit deforestation activities. Financial institutions have, as we have shown, a clear direct incentive to support this work.

References

Bolton, P., Despres, M., Pereira da Silva, L.A., Svartzman, R. (2020). The green swan: central banking and financial stability in the age of climate change. Bank for International Settlements, Basel, Switzerland.

Ferrante, L., Getirana, A., Baccaro, F.B., Schöngart, J., Leonel, A.C.M., Gaiga, R., Garey, M.V., Fearnside, P.M. (2023). Effects of Amazonian flying rivers on frog biodiversity and populations in the Atlantic rainforest. Conserv. Biol. 37, e14033. https://doi.org/10.1111/cobi.14033

IEA. (n.d.). Climate Impacts on Latin American Hydropower.

Lamb, C., Calderon, P., McDonald, J., Cerrato, D., Reinhammar, T., Lonnqvist, C., Power, J., Willis, J., Fougler, A. (2022). High and Dry Report.pdf. Carbon Disclosure Project.

Lenton, T.M., Rockström, J., Gaffney, O., Rahmstorf, S., Richardson, K., Steffen, W., Schellnhuber, H.J. (2019). Climate tipping points — too risky to bet against. Nature 575, 592–595. https://doi.org/10.1038/d41586-019-03595-0

Mapstone, N. (2011). Hydroelectric dams: Spate of dam building meets resistance. Financ. Times.

McCauley, D., Pettigrew, K.A., Heffron, R.J., Droubi, S. (2023). Identifying, improving, and investing in national commitments to just transition: Reflections from Latin America and the Caribbean. Environ. Sustain. Indic. 17, 100225. https://doi.org/10.1016/j.indic.2023.100225

Santander. (2021). Santander and the Brazilian Amazon.

Shu, J., Qu, J.J., Motha, R., Xu, J.C., Dong, D.F. (2018). Brief discussion of impacts and strategies of climate change on small hydropower development. IOP Conf Ser. Earth Environ. Sci. 163.

Stand.Earth (2022). Statement on BNP Paribas Pledge To End New Financing for Amazon Oil Drilling.

Svartzman, R., Espagne, E., Gauthey, J., Hadji-Lazaro, P., Salin, M., Allen, T., Berger, J., Calas, J., Godin, A., Vallier, G. (2021). A “Silent Spring” for the Financial System? Exploring Biodiversity-Related Financial Risks in France.

Weng, W., Luedeke, M.K.B., Zemp, D.C., Lakes, T., Kropp, J.P. (2018). Aerial and surface rivers: downwind impacts on water availability from land use changes in Amazonia. Hydrol. Earth Syst. Sci. 22, 911–927. https://doi.org/10.5194/hess-22-911-2018

Zanin, P.R., Satyamurty, P. (2020). Hydrological processes interconnecting the two largest watersheds of South America from seasonal to intra‐monthly time scales: A critical review. Int. J. Climatol. 40, 3971–4005. https://doi.org/10.1002/joc.6443