Chapter 10

Conclusion

Megan Meacham and Victor Galaz

The Amazon region has been long recognized for its ecological diversity, importance for the climate system, and deep significance for people and indigenous communities in the region. Over time, we have come to understand this iconic biomes’ importance for local communities, Latin American countries’ economies, and the possibilities for a prosperous future for all. In a globalized world, what happens in the Amazon does not stay in the Amazon. Protecting its resilience for the future in ways that are ecologically viable but also socially just, is an issue of global importance and concern.

This report has shown the various ways that humans, ecosystems and the climate system are interwoven, based on the latest insights from the resilience and sustainability sciences. While this close interconnection between the social and ecological might sound obvious, a growing body of research that explores the connections between economic activities, financial investments, and social- ecological change consistently shows system fragilities and risks that remain unaddressed by key decision-makers in the public and private sector.

Economic development depend on the functioning of the biosphere, but are eroding long-term sustainability by threatening biodiversity and altering ecological processes, all with unequal impacts on people in the region. Businesses and financial actors depend on stability and predictability, however, there are large risks of abrupt and irreversible changes that would fundamentally alter the material foundations for economic activities, and limit the predictability for future investments. The Amazon region is changing at unprecedented speed, forcing us all to rethink the role of public and private investments.

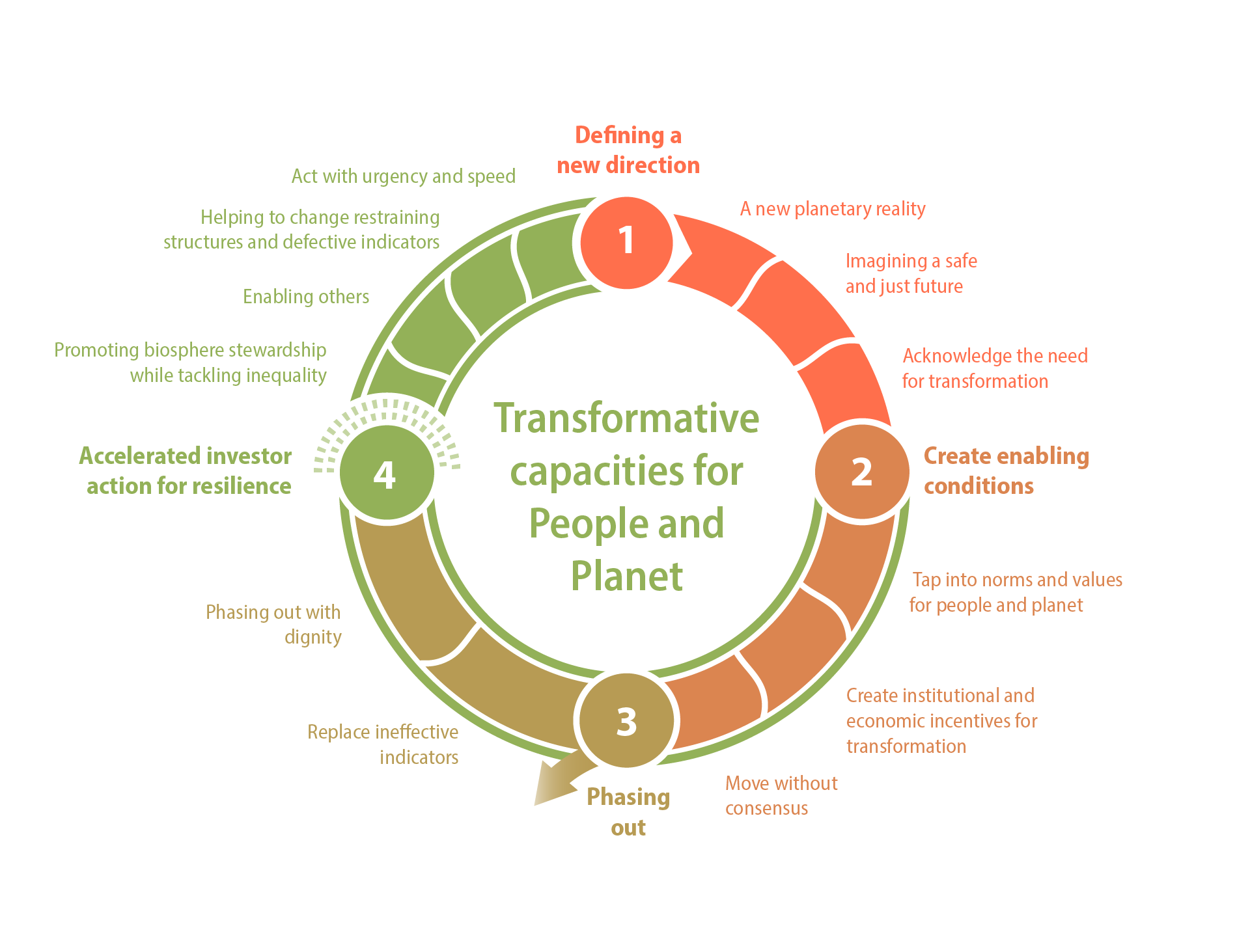

In 2022, we presented a simple framework to assess the role of finance to support a just transition towards sustainability. We believe that this framework is just as applicable when discussing the future of the Amazon.

A plan for finance to support resilience and a just transition for the Amazon needs to acknowledge its rapidly changing reality, including possible abrupt and cascading changes (Chapter 4 and Chapter 5). It also needs to consider the multiple cross-national connections between investors (Chapter 3), and challenging systemic risks for investors that evolve as a result of loss of the web of life (Chapter 2), and shifts in major biosphere dynamics such as precipitation patterns (Chapter 6).

Fortunately, new technologies (Chapter 7) and new science-based approaches such as natural capital assessments (Chapter 8) are helping to understand these processes and the investments, policies and regulations that will ensure their sustainability to both people and planet. There is an urgent need to expedite the use of such tools that both help phase out harmful investments, and support accelerated investor action for resilience. This alignment of financial actor interests and the needs for environmental protection is an opportunity for both governments and private investors to invest in ‘nature positive’ projects. The ambition can no longer be to solely limit damages, but restoration and regeneration will be necessary to stabilize the resilience of the Amazon biome.

Recognizing the interconnectedness of ecosystems and human communities, it is imperative to prioritize the involvement of local communities, especially indigenous groups, in decision-making processes. Respecting and protecting the rights of these communities is not only ethically sound but also vital for the overall success of initiatives like “Amazonia Forever”. As our colleagues have shown (Chapter 8, and 9), that social equity goes hand in hand with strategic investment decisions.

Sustainable investments aligned with responsible practices can pave the way for a just and resilient Amazon, contributing to the well-being of current and future generations.

There is still time, yet no time to waste.