Chapter 3

How finance influences the emergence of novel disease risks

Victor Galaz

Zoonotic diseases can have devastating effects on human health and societies. The COVID-19 pandemic is a stark reminder of how such emerging and re-emerging infectious diseases (EIDs) at times propagate through transnational trade and travel routes and overwhelm fragile health systems. Unfortunately, such risks to both human and animal healthcare are likely to increase substantially in the near future due to the combined effects of climate and land-use change (Carlson et al., 2022).

There is an increased recognition that human activities including deforestation, the expansion of agricultural land, and increased hunting and trading of wildlife, can be linked to the emergence and re-emergence of such diseases, in particular of zoonotic and vector-borne diseases (Allen et al., 2017; Marco et al., 2020). The production of certain types of high deforestation-risk commodities such as palm oil, have been linked to increased zoonotic spill-over through land fragmentation and habitat loss (Morand et al., 2021).

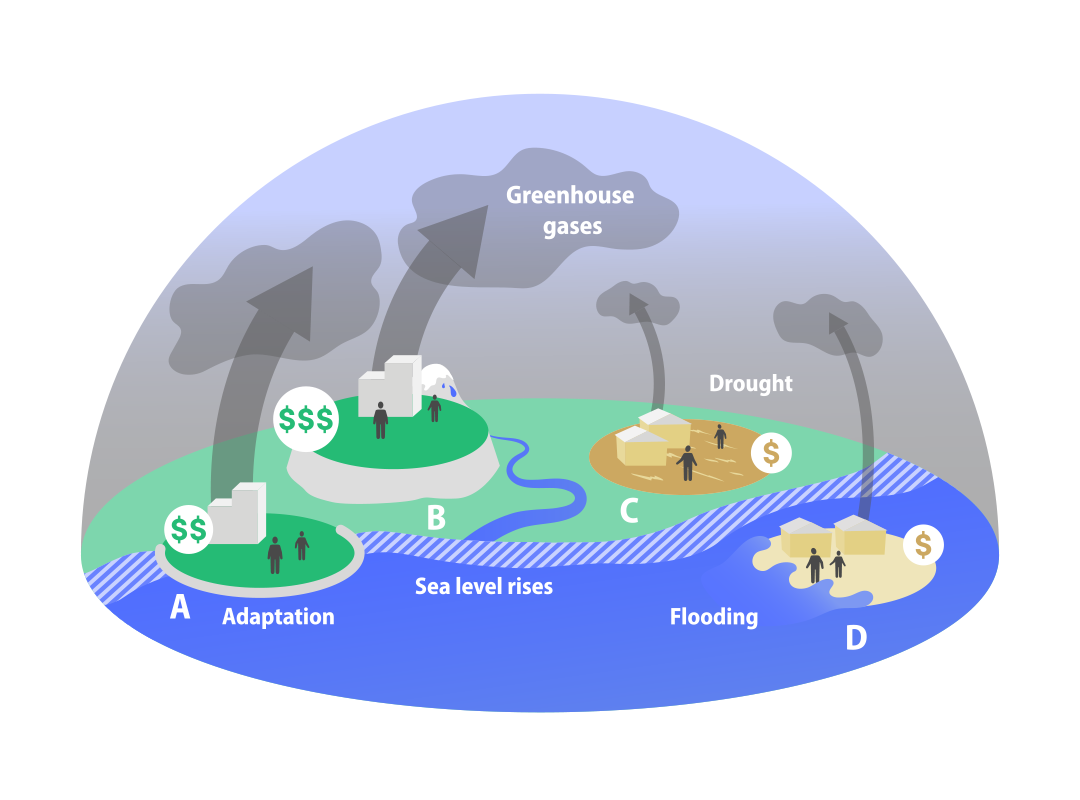

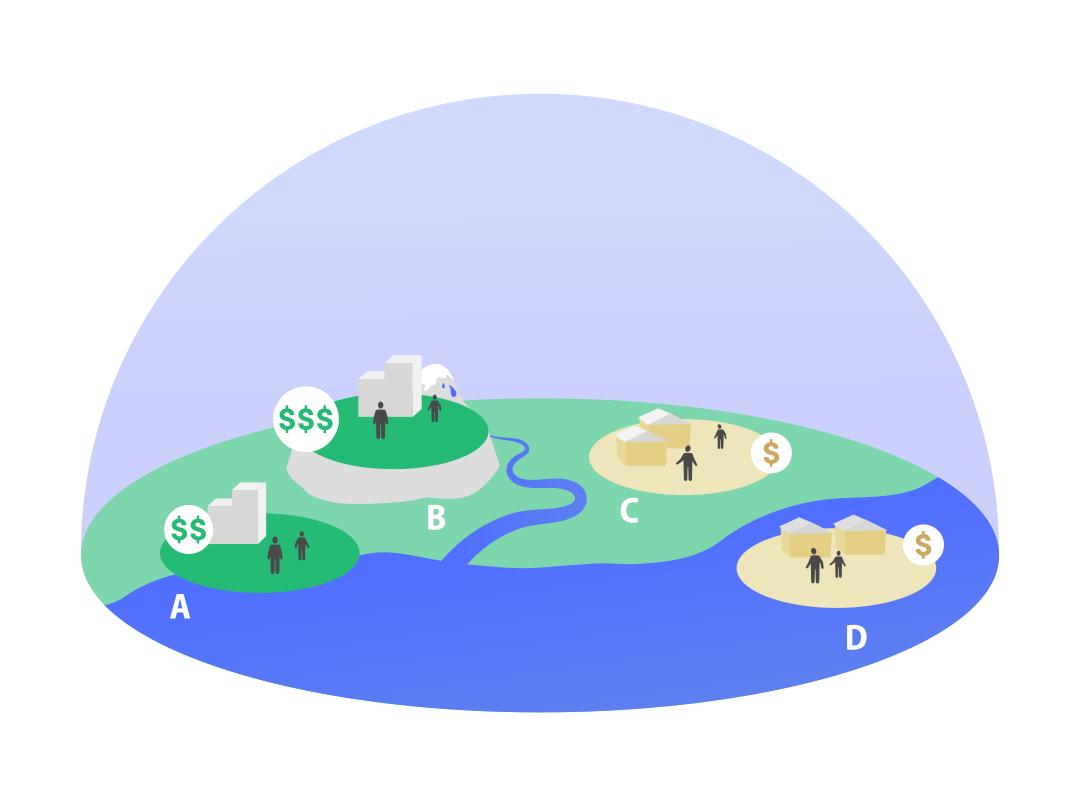

In today’s globalized economy, many large companies rely on obtaining external capital from financial institutions to expand their operations and increase production with notable environmental, ecological and social impacts in both land- and seascapes. This means that financial investments and institutions such as banks, pension funds and multilateral development banks may indirectly affect ecological dynamics by funding – and benefitting economically from – extractive activities that create new patterns of interactions between pathogens, non-human animals, and humans (Galaz et al., 2023).

For example, consider financial institutions which hold significant shares in companies that cultivate maize, rice, sugar cane and soybeans for international markets. Through their voting rights as owners, such institutions indirectly hold influence over corporate activities that drive the conversion of landscapes that help maintain rodent populations and rodents’ breeding sites, which in turn increases the rodent zoonotic disease spread through inhalation of infected aerosols particles stemming from the rodents’ urine, faeces, or saliva (e.g., hantaviruses, see Galaz et al., 2023).

Financial influence – but where?

Financial instruments such as equity, loans and bonds provide pathways for investors interested in influencing the policies and actions of companies. Financial institutions such as pension funds for example, engage in direct dialogues with corporate management, use their voting influence at corporate annual general meetings, and sometimes threaten to divest as a way to influence companies to act on issues that are central to their interests. When successful, such engagements can have considerable “downstream” effects when large companies choose to use their dominating market position and globally spanning supply chains to advance sustainability and climate ambitions (Folke et al., 2019).

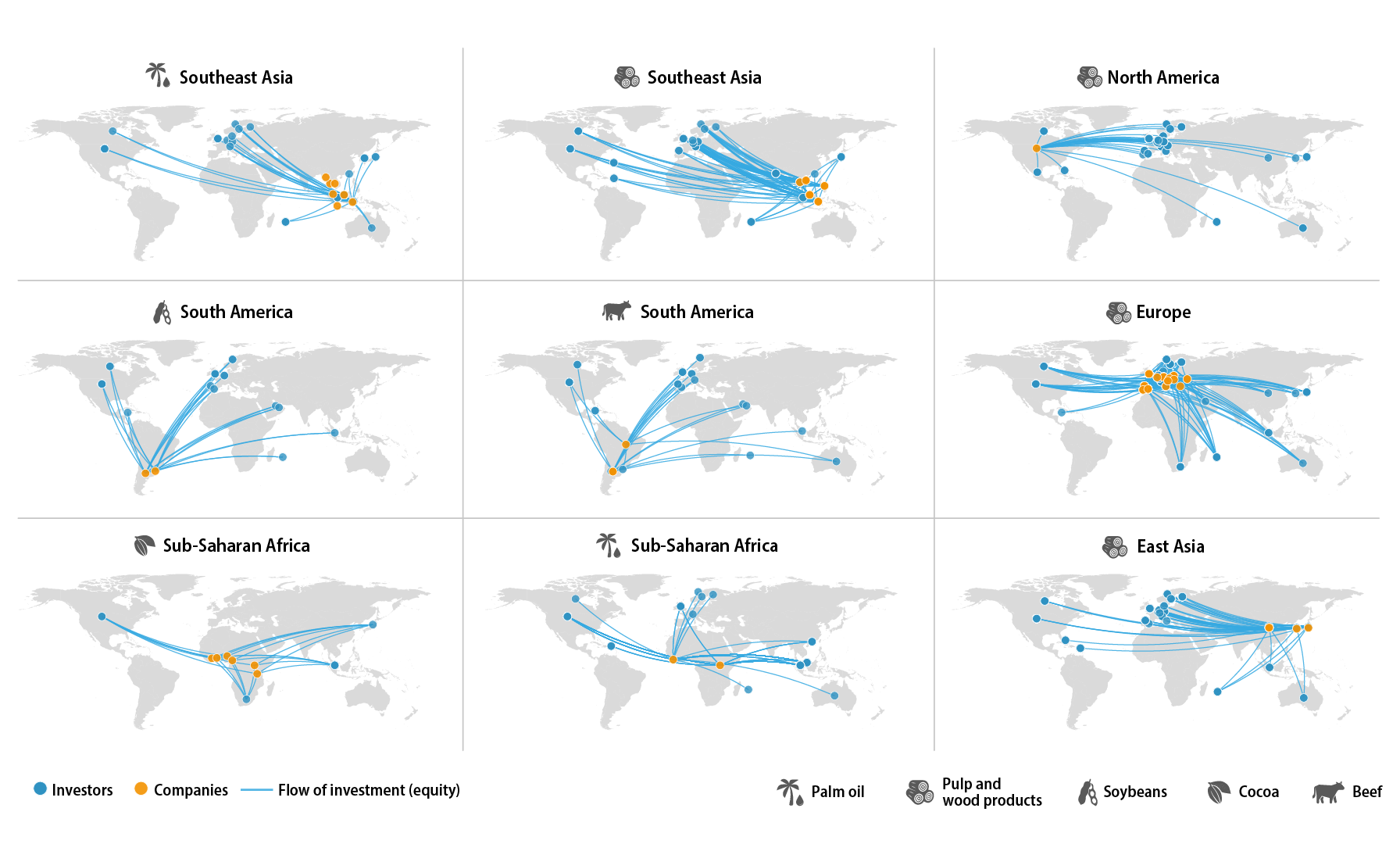

But where in the world is such financial influence at all possible? A recently published study (Galaz et al., 2023) analyzes the possibilities of such influence by tracing equity investments in companies and regions in the world where EIDs risks have been shown to be particularly high and associated with deforestation risk prone commodities. Figure 1 shows the overall investments patterns in six different regions of the world, and two cases in Latin America associated with deforestation-risk commodities.

Figure 1. Global connections of investments through equity | Financial investments shape the biosphere, and as a result also emerging and re-emerging disease risks through investments in economic sectors associated with anthropogenic land-use changes in known zoonotic disease “hotspots”. The figure includes N=54 companies and shows the global characteristics of such investments in the nine selected regional case studies, as well as the respective investment size through equity in USD. Purple nodes are where companies and investors overlap geographically. Note that the figure is a simplified data-based animation based on (Galaz et al., 2023).

There is a consistent large role (and potential influence) for U.S.-based asset managers through their diverse ownership in key sectors associated with anthropogenic land use change (Galaz et al., 2023).

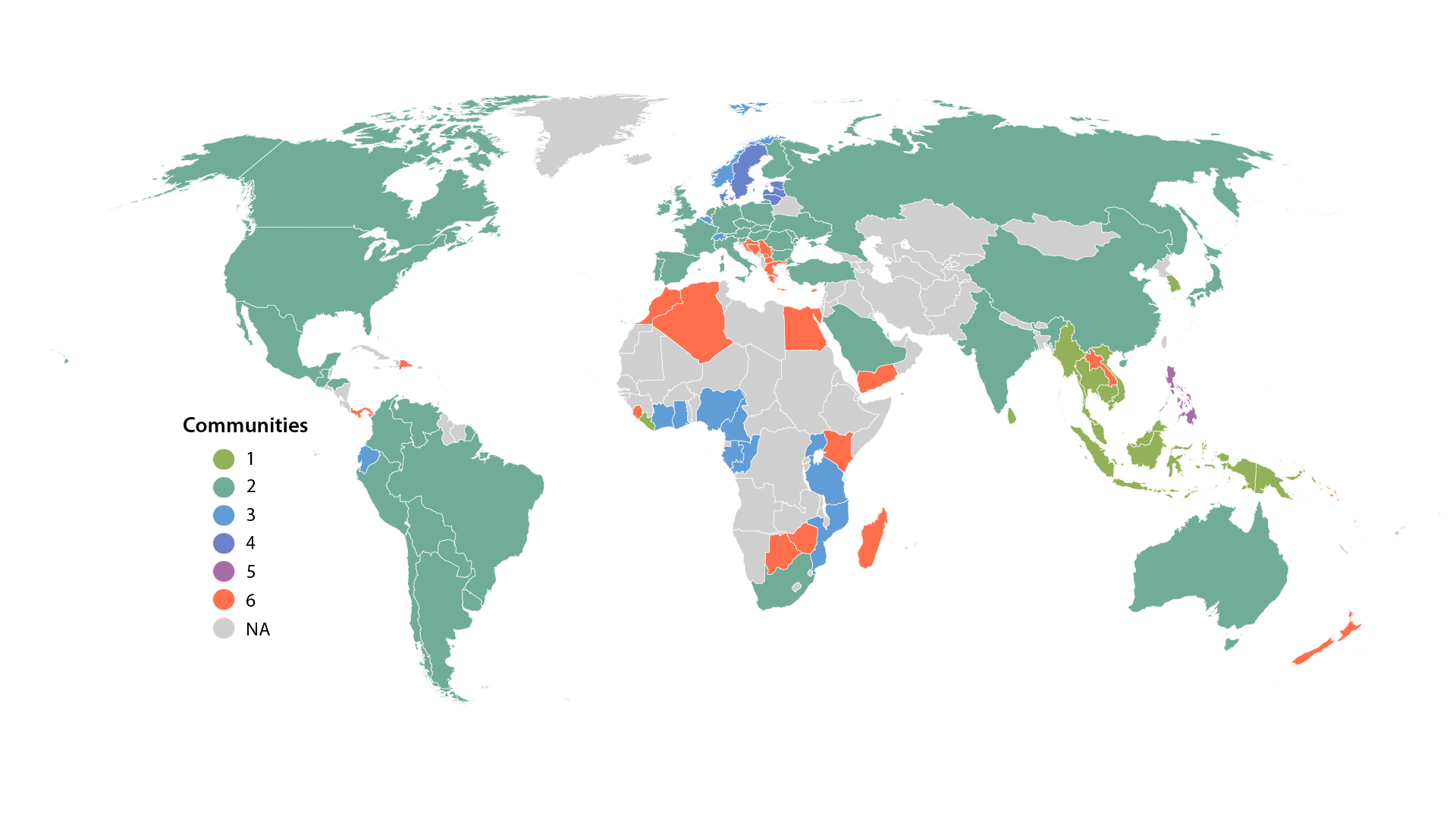

However, there are important regional differences, especially for Latin America (Figure 2). International attempts to leverage financial influence for planetary health thus not only has to consider dominating global investors, but also has to be adapted to specific regional ownership patterns. Hence, while the prevention of EIDs risks requires global cooperation, progress in mitigating global risks can also be made through strategic alliances between a smaller subset of countries (e.g., Aakre et al., 2019), and through other centrally placed companies and private sector actors (Folke et al., 2019).

Figure 2. The figure shows the different constellation of countries who collectively could help mitigate EIDs risks linked to deforestation risks. Each community shares company headquarters and financial entities associated to economic activities in regions of the world with elevated EIDs risks. From Galaz et al., 2023, Figure 4A.

The unequal nature of global commodity trade and financial investments often leads to financial institutions investing in companies operating in countries with higher corruption, inequality, and/or weaker rule of law. This observation reemphasizes the need to develop investor policies and engagements that consider limited government capacities.

On January 20th, 2022, the International Monetary Fund raised its forecast for the economic costs of the COVID-19 pandemic on the global economy to US$12.5 trillion through 2024 (Reuters, 2022). These numbers show the large economic impacts and material financial risks created by emerging and re-emerging diseases, and the tangible economic incentives investors and governments have to address such diseases proactively. It can also be seen as one illustration of the possible cascading effects that result from financial investments as they impact on ecosystems, only later to feedback on the economy and on the financial system itself (Sanchez et al., 2022).

Financial influence can – and should – be mobilized to complement the work assumed by governments and international organizations by building alliances with investors with similar interests and using that collective influence to engage with the corporate sector in ways that advance financial transparency of EID-risks, and support the development and implementation of corporate policies aligned with a planetary health agenda.

References

Aakre S, Kallbekken S, Van Dingenen R, Victor DG. (2017). Incentives for small clubs of Arctic countries to limit black carbon and methane emissions. Nat Clim Chang.

Allen T, Murray KA, Zambrana-Torrelio C, Morse SS, Rondinini C, Di Marco M, et al. (2017) Global hotspots and correlates of emerging zoonotic diseases. Nat Commun. 8(1):1–10.

Carlson CJ, Albery GF, Merow C, Trisos CH, Zipfel CM, Eskew EA, et al. (2022). Climate change increases cross-species viral transmission risk. Nature. 607.

Folke C, Österblom H, Jouffray JB, Lambin EF, Adger WN, Scheffer M, et al. (2019). Transnational corporations and the challenge of biosphere stewardship. Nat Ecol Evol. 3(10): 1396–403.

Galaz, V., J. C., Rocha,. P. Sanchez et al. (2023). “Financial dimensions of zoonotic disease risks: an integrative analysis of financial influence and emerging and re-emerging infectious disease”. Lancet Planetary Health.

Marco M Di, Baker ML, Daszak P, de Barro P, Eskew EA, Godde CM, et al. (2020). Sustainable development must account for pandemic risk. PNAS. 117(8): 3888–92.

Morand S, Lajaunie C. (2021). Outbreaks of Vector-Borne and Zoonotic Diseases Are Associated With Changes in Forest Cover and Oil Palm Expansion at Global Scale. Frontiers in Veterinary Science | www.frontiersin.org. 8:661063.

Reuters. (2022). IMF sees cost of COVID pandemic rising beyond $12.5 trillion estimate.

Sanchez P, Galaz V, Rocha J. (2022). Finance, climate and ecosystems: A literature review of domino-effects between the financial system, climate change and the biosphere. Beijer Discussion Paper No 278.